TL;DR

- Insurance is adopting digital tech to streamline operations and improve customer experiences.

- Insurers use data, AI, and automation to enhance decision-making and claims processes.

- Digital transformation enables personalized offerings and innovative services.

The world is changing, digitally. We are moving towards an era of lessened human intervention. Rapidly evolving technologies have brought huge disruptions to their digital platforms. We are seeing autonomous cars, contact less payments, and chatbots that advise people on how to manage their wealth and investments.

Netflix, Uber, Ola, Amazon, and many other ideas have transformed their industry segments forever with seemingly effective and yet simple ideas. The insurance industry is embracing digital transformation in various ways to mitigate complex challenges it is facing from consumers, regulatory and digital landscapes.

Global Insurance industry leaders are working on developing digital enterprise portals that are built for future needs. They encompass meeting future demands with predictive analytics, report on the financial performance of products, and plans to provide a bird’s eye view of all the micro and macro indicators of the insurance business.

What benefits digital transformation bring for insurance companies?

People are now using their devices to upload documents, make claims, use mobile apps for payments and get reminders and updates for their insurance policies. As the world embraced mobility, the insurance industry had to tag along for digital innovation.

They undertook changes within their operations by taking on small but vital process changes. Early adopters have notched up their capabilities for long-term gains. They have generated great business values to win more customers and gain comprehensive benefits like:

- Faster access to market for insurance products and services.

- Predictive Analytics allow critical business insights to take faster decisions.

- Process automation for core business operations.

- Synchronous processes increase sales, productivity and profits.

- Integrated design and systems enhance customer experience.

- Reduced cost and time in business operations.

- Improved claims processes and increased underwriting efficiency.

What are the key ingredients to achieving digital transformation?

Modern consumers engage with insurance companies on multiple channels. They research, recommend, share and make purchase decisions via omnichannel applications. Digital insurance providers need to combine all the key components that can drive customer engagement at multiple levels to ensure success.

Innovation and Agility: Allow a customer to engage both online and offline with limited human interaction.

Culture and Workforce: Train your employees, customers, and partners through modern learning management systems for greater engagements.

Interactive Design: Provide a seamless shopping experience with clear instructions and pricing.

Data and Analytics: Use data to understand customer behavior and analytics to help him make informed purchase decisions.

Governance and Policies: Make and mark clear rules for every product and policy to stay on the right side of the law.

Risk and Cyber security: Update systems and website to protect data and privacy.

Digital Architecture: Develop Digital Experience Platforms that are robust and omnichannel.

Customer Dashboards: Create objective and personalized dashboards for all the stakeholders.

What are the phases of digital transformation for Insurance Sector?

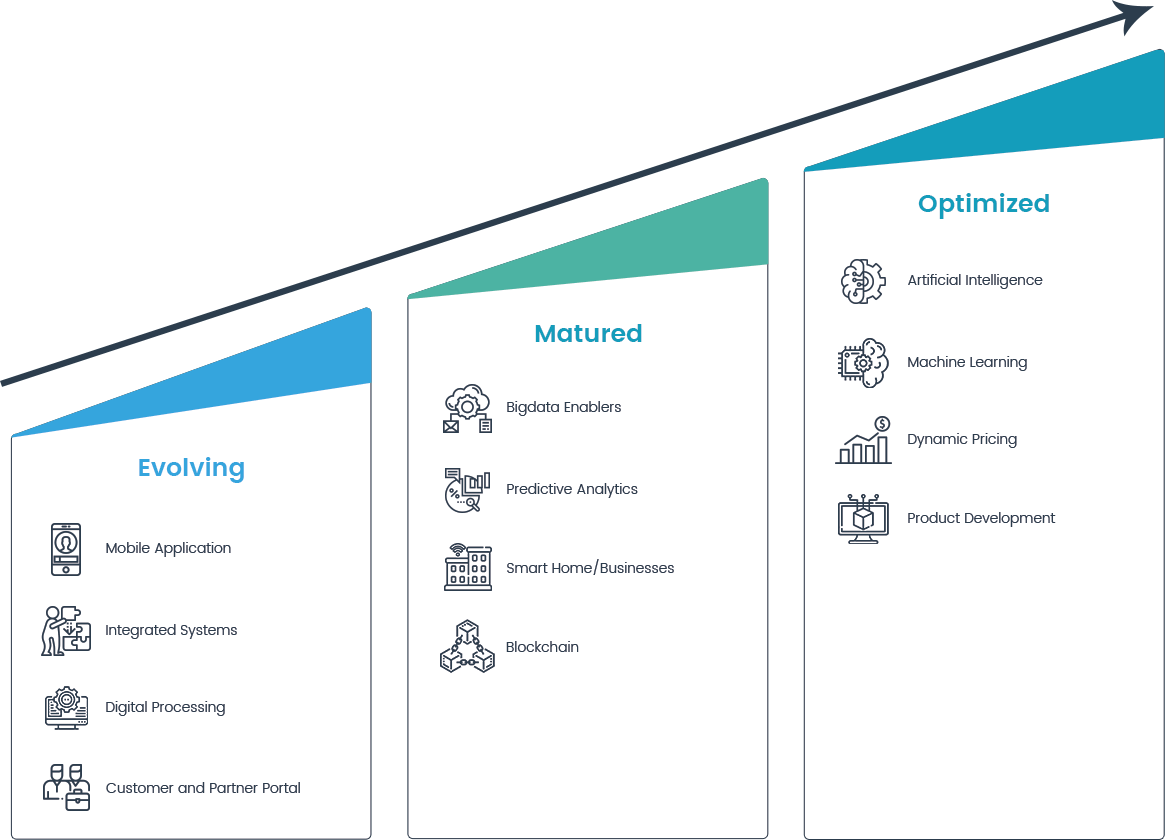

Insurance companies can seamlessly transform into digital insurance providers with a phased roadmap. They can assess their current situations, systems, and infrastructure to plan which processes and part of the business will move to the digital landscape. This helps in prioritizing investment and building digital workplaces that are built for future needs.

Long-term evolution with near-term value addition is the most effective strategy for the insurance industry that is driving digital transformation strategy in three primary phases as per their capabilities.

Evolving: Just beginning to realize the potential of digital transformation. Working on several initiatives to automate their processes and calibrate their business model to suit their business requirements.

Matured: Uses advanced digital technologies and enterprise portal solutions integrate emerging trends for rapid product development and launch.

Optimized: Working towards futuristic solutions using NextGen technologies by analyzing integrated systems and innovative products that transform the experience of all the stakeholders.

What are the Emerging Trends in digital transformation for Insurance Industry in 2019?

A recent survey by Deloitte called on the insurance industry to transform their operations digitally. Of the users surveyed, 7 out of 10 insurers have already started implementing various digital strategies.

The survey suggested that there are an overall 30% improvements in underwriting process after they made the whole process online. Their Net Income increased by 45% YoY and EBITDA improved by 28%. The survey overwhelmingly suggests that the insurance industry is moving their business processes and operations online with great results.

After studying many surveys and speaking with many industry leaders we have compiled a list of trends that might come true in the coming year of 2019.

Interconnected Portals and Systems: Communication is the key in digital businesses. The insurance industry has already implemented partner portals, enterprise portals, and Intranet portals. There will be attempts made to consolidate all of them on a single platform moving away from different legacy technologies to create an omnichannel digital ecosystem.

Self-serving Dashboards: Viewing all the information from a top view is vital in making decisions. Customer and partners will benefit greatly by getting a bird’s eye view of their performance, policies, prices, maturity and payment dates. Getting all vital information at a single place will become an inseparable part of an insurance enterprise system.

Compare and Buy: Consumers will be moving online to make a better purchase decision by comparing policies in various insurance portals. It will get them to understand terms, conditions, pricing and many other details before making a final decision about their life, medical, auto or insurance policies. This is where insurance company’s enterprise mobility solutions will become a catalyst for higher revenues and customer retention.

Seamless Claims Management: Consumers will take photos, upload documents and select their respective policies to make claims and insurance providers will scan and screen documents to settle these claims. The whole process of making and settling insurance claims will go online.

Cloud computing: The future is in the clouds. In the survey, 80% insurance providers agreed that they are either moving some of their business functions over the cloud or have already shifted to cloud storage.

Big data and analytics: With more and more users coming online to purchase insurance policies, insurers will be able to utilize that huge amount of data to understand consumer requirements and adjust their policies to meet them. With advanced analytics, they will be able to predict the type of insurance policies, claims management and profiling of customers to ensure total transparency.

Development Methods: Most IT companies are choosing to develop their software using Agile methods. Increasingly enterprises are driving digital transformation using DevOps as the preferred method of application development.

IoT and InsurTech: Insurance sector is applying beacons and GPS tracking to cars, industrial vehicles and many other instruments to monitor their usage. InsurTech (Insurance Technology) will help insurers to understand their usage and log their activities to create custom insurance products and services for individual policyholders.

Improvements in the AI: Automated chatbots working as advisors will become more common. They will even begin suggesting select consumers about different policies based on their past purchases and future requirements. We may even see some robotics in physical verification of claim settlements but with limited success as it still is into nascent stages. But overall Artificial Intelligence will get better in the coming days.

Wearable Gadgets: This holds the most potential and far-reaching effects for the insurance industry. Smart devices like iWatch, fitness trackers, and other monitors track user activities and health in real-time with mobile applications. This enables insurance companies to modify their insurance policies to accommodate the needs of individual users depending on their health.

The interesting thing is, the gadgets notify users and service providers of any health risks, or if a user has or is suffering from any ailments, allowing both to take preventive measures.

We can see a transformation in both the approach and the strategy within the insurance industry as a sign of the digital transformation. The automation of claims management, policy updates and compensation has seen great advancement with digitization. This makes it certain that insurance providers who will adopt early to the changing digital era will thrive by beating their competitors. And, those who will come late to the party will see their prospects plummet rapidly. Want to take lead in the insurance market with digital solutions?

Anblicks is a Data and AI company, specializing in data modernization and transformation, that helps organizations across industries make decisions better, faster, and at scale.