Identify Your Most Profitable Customers Using Customer Lifetime Value

- Explore how to define Customer Lifetime Value (CLV) and its calculation methods.

- Analyze customer data to segment and identify high-value customers.

- Use insights from CLV to inform marketing strategies and resource allocation.

Businesses are built around Customers. Understanding customer value is by far the most important thing that impacts its viability and sustainability. Customer lifetime value(CLV) gives an understanding of how profitable a customer will be throughout his journey with the business. Therefore, modelling CLV becomes one of the most critical and challenging problems.

Businesses can easily segment their customers into low, medium and high-value segments and target their resources to the right group maximizing the returns using CLV information.

If the customer value is understood, we can:

- Determine which customers to invest in.

- Identify new customers and markets to target.

- Agree which product and service lines should be offered and promoted.

- Change pricing to extract more value.

- Identify the unprofitable customers.

- Understand where to cut costs and investments that are not generating growth.

Customers differ in their purchasing habits in terms of frequency of visits, recency of visits and the amount spent in their visits. Hence, the customers differ in the value they make for the business. The Pareto principle states that 80% of the revenue is generated by 20% of the customers. CLV helps business understand their most profitable customers and tailor their marketing strategies targeting them to maximize the return on investments.

There are many definitions for CLV but the most popular definition is the amount of future revenue generated by the customer. Similarly, there are many techniques available in the literature on modelling CLV. CLV can be historic or predictive.

Historic Customer Lifetime Value

Historic CLV can be simply calculated from user’s past behavior without any estimation on his future behavior. It can be as simple as average revenue of the user per month (ARPU) multiplied by the total months he transacted with the business.

This is the simplest and most common technique to calculate CLV. However, there are big limitations in ARPU model. It does not capture heterogeneity in customer behavior. It considers all the customers the same.

Further, this model assumes that the customer behavior will be constant throughout the customer journey which is not true. ARPU estimations could often be misleading and give a poor estimate of CLV.

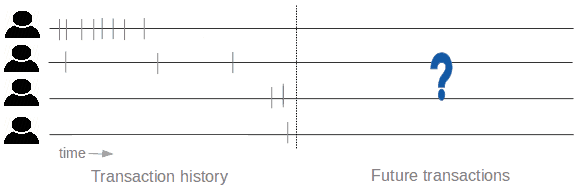

To further understand how customer behavior can change over time, please refer to the figure above. From the past transaction history, user 1 looks like a frequent visitor. But recently the user is showing deviation in his usual behavior and has become infrequent.

This could mean that though the user looks valuable from his past transaction history, he may become inactive in the future. Thus, his future CLV value should be low. On the other hand, user 2 has a low frequency of visits and has fewer transactions but he may still be active in the future and bring more value to the business.

Also, hard conclusions cannot be made on the new users like user 3 and user 4 as they are observed for less time. Predictive CLV is used to estimate the future value of the customer appropriately. It overcomes the limitations of historic CLV by modelling the purchase behavior of the customers.

Predictive Customer Lifetime Value

Predictive CLV requires modeling of the customer’s spent rate to estimate how much he may spend in his visit, purchase rate to estimate how frequently he will buy in the future, and his average lifespan. It considers customers’ dropout/ churn rate to predict the lifespan of an individual.

However, it is not trivial to predict the future purchase pattern of the customer as it depends on the type of business (contractual/ non-contractual) and requires an understanding of the modeling techniques.

There are many modeling techniques in literature like Pareto/NBD, Gamma-Gamma model for monetary value, BG/BB, etc. We chose Pareto/NBD as the best model to predict CLV in non-contractual settings which were able to identify the most profitable class of customers – GOLD with 76% accuracy.

Anblicks is a Data and AI company, specializing in data modernization and transformation, that helps organizations across industries make decisions better, faster, and at scale.